Risky assets have been on the move lately. This can be seen in multiple asset classes. The first sign that we are in a Risk On environment is the widening of spreads on US Treasury Debt versus other governments' debt. US Treasuries are considered by many the ultimate safe haven and so tend to enjoy a premium when investors are worried. The premium shrinks or disappears when the worries go away.

|

| Source: Wall Street Journal |

|

| Source: StockCharts.com |

|

| Source: Dr. Ed's Blog |

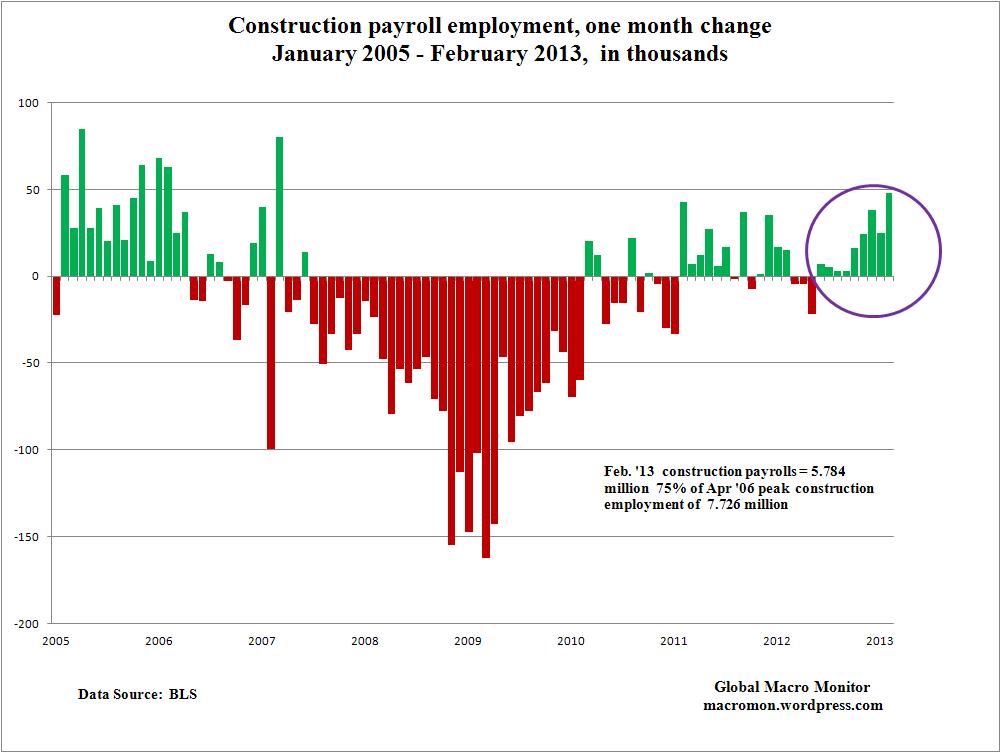

On the economic front, while the 'fiscal cliff' and 'sequester' would appear to have taken away much of our margin for error on the growth front, there are positive signs coming from the private sector. Construction employment, which tends to pay well, is coming back, along with the housing market. And both would appear to be still early in the game.

On a more global and esoteric note, South Korean exports, which tend to be a leading indicator of global exports, are growing. This is despite the increased geopolitical tensions on the Korean Peninsula. North Korea recently cancelled the Korean War ceasefire and cut off the hotline to South Korea.

Source: Humble Student of the Markets

Other signs of healing include Ireland's first successful ten year debt auction since 2010, Spanish and Italian ten year yields both nicely under 5%, and yields on 'junk' bonds hitting a record low of 5.56%. Overall, investors seem to be taking a positive view of things. With things relatively calm on the investment front, I would urge you to make sure you know what your goals are for your investments, what the time frames for those goals are and have a plan in place and know what you will do given different scenarios. It is much easier and better to do this without the influence of sharp emotions and media hype.

In Japan meanwhile, the Nikkei continues to move up.

Source:StockCharts.com

With the Yen moving down at the same time, the currency affect needs to be hedged out. While it does not track the Nikkei, the Wisdom Tree Japan Hedged Equity Fund (DXJ)* does hedge out the currency risk and has been a good way to play this rise.

Source: StockCharts.com

While DXJ has moved up significantly since the middle of November, the valuations are just reaching the average for the last five years:

Source:ETF Research Center

Source:ETF Research Center

While the speed and size of the move would indicate caution, the valuations would indicate, that there is still more room to go before we get into overvalued territory. That DXJ has increased almost 40% in approximately 4 months and has only now reached its average valuations for the last five years, gives an indication of how far sold it was. Currently, allof this has been based on the election results, statements, intentions and the nominee for Bank of Japan Governor. We have not seen much hard action. The situation needs to be watched carefully for continued follow through and success on the part of the Japanese authorities and economy.

*Disclosure: I own DXJ and some vertical call spreads on DXJ in my accounts.

No comments:

Post a Comment