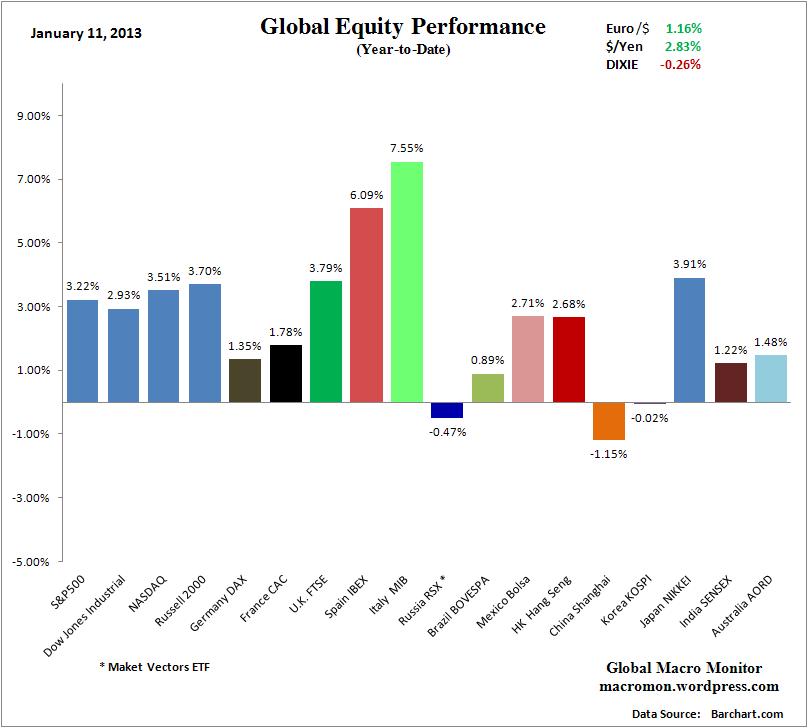

The markets have been on quite the tear recently. The S&P 500 Index finished above 1,500 on Friday and is within 5% of its all time high. Good news abounds and investors seem very optimistic(see

Is the Whole World Bullish?). So what does this mean for your portfolio? Is it time to dive in with both feet? Or is it time to take some funds off the table?

There are two opposing possibilities at play here. The bullish case is that we are only in the early stages of a long run bull market in stocks and is supported by two main pillars. The first is that the 'Great Rotation', the shift back into equities by the retail investor, has begun. The big inflows into equity mutual funds and ETF's this January after years of outflows are brought out as evidence of this. The second pillar is that the secular bear market, that started in 2000 is over. A good summary of this case was tweeted in early January by noted technician

Ralph Acampora, who continues to be bullish.

The bearish case has multiple pillars. The Shiller 10 year adjusted P/E is still over 20, Europe's structural problems continue, the US faces increased regulation and legislative gridlock, Japan is initiating a new currency war, the UK is on the verge of a triple dip recession and S&P 500 earnings, while better than expected are barely growing. At the same time everyone is getting optimistic, so it must be time for a correction.

So what to do? Remember, it all comes back to you and what works for you and what your goals are. As in most cases, it is better to have a plan in place in case of emergency than to have to think one up as the world falls apart. The same is true of investments. If you don't have a plan in place, make sure your advisor does. And make sure you are both on the same page about it. If not, get a plan in place.

First I would check to make sure that your portfolio's overall asset allocation is in line with your planned targets. If not, rebalance back to them. The next step is where looking at investments through multiple time frames comes in handy. So as not to miss the potential for a long term advance, I would leave long term core positions in place. This is because while long term stock P/E's are expensive, as the old Wall Street saying goes "Markets can stay irrational longer than you can stay solvent." Alan Greenspan's 'Irrational Exuberance" speech was in 1996. The markets continued to go up until 2000. And you don't want to miss that type of ride. Also, what if the bulls are right and we are in the beginnings of a secular bull market? The last one went from 1982 to 2000. And you definitely don't want to miss that ride.

But what if the bears are right? For that scenario, any short term, trading, or tactical positions should be reviewed and possibly have their risk management parameters adjusted. In addition, I would be very careful about initiating new positions at this point. Particularly any marginal ones. A 5-10% stock market correction could offer a better entry point. That does not mean don't buy anything at all, it just means you should be more selective and only initiate positions in those investments with truly compelling reward-to-risk ratios. Anything close to a previously researched upside exit point, would be on a very, very short leash, so as to preserve the gains.

By having a plan and looking at the markets through multiple time frames, it is much easier to block out alot of the constant noise from the street and achieve your financial goals. What's your plan?