It was generally a good week in terms of economic reports. While fourth quarter GDP came in slightly negative, much of it was due to inventory destocking probably associated with fiscal cliff uncertainty. In contrast, the Case Shiller Home Price Index, ISM Manufacturing Index and Construction Spending all rose. And while fewer jobs than expected were created in January, this was cancelled out by strong upward revisions to prior months data. All this positive information helped power the S&P 500 further upward to close at 1,513 and the Dow Jones Industrial Average at 14,009.

| Source:Yahoo Finance |

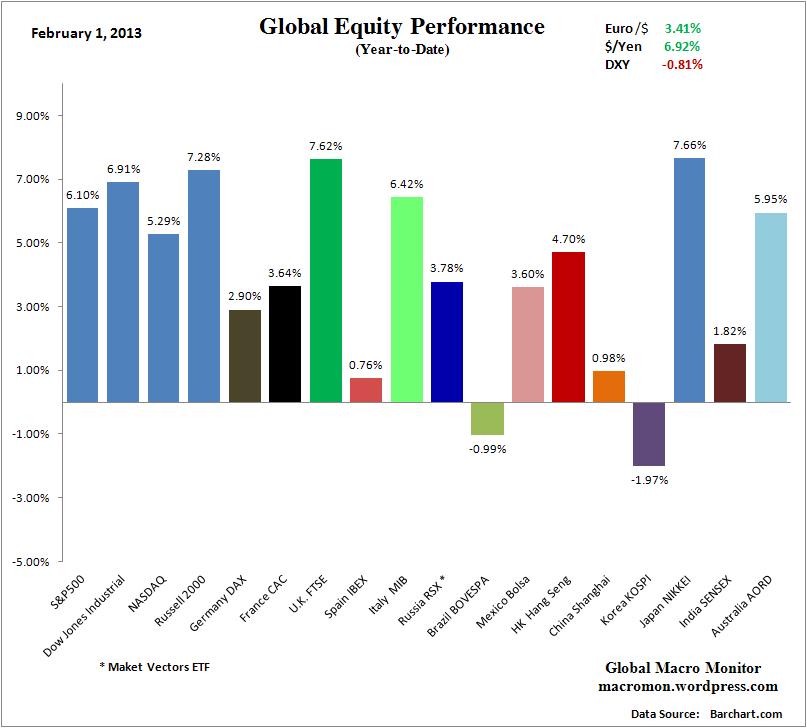

This stock market strength has not been confined to the US as can be seen in the chart below. Both the London and Tokyo markets are doing even better than either the S&P 500 or the Dow Jones Industrials.

The flip side of all this good economic news was the rising yield on the ten year US Treasury Bond. It closed over 2% for the first time in almost a year, which was 25 basis points higher than the start of the year. This rise in yields was equal to over a 3% point loss in value.

| Source: Yahoo Finance |

This week in the US, we get factory orders on Monday and chain store sales on Thursday. Thursday is also a big day internationally, with German Retail Sales, Unemployment and CPI, Japanese Household Spending and Unemployment and Chinese PMI.

With all of this data coming out, combined with the tremendous wave of liquidity continuing to spew from central banks around the world and the US indexes approaching their highs, it should be an interesting week. Time to brush up on your surfing skills.

Source: BBC.com

No comments:

Post a Comment