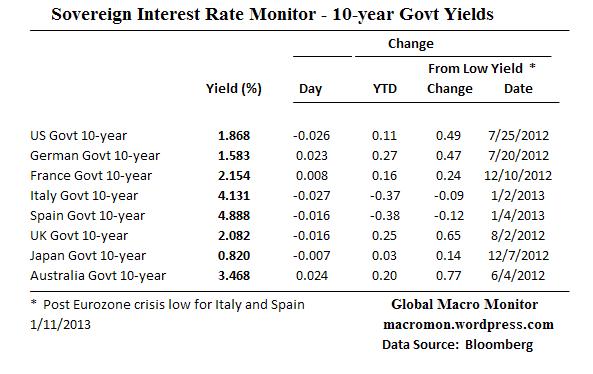

Last week was generally a good one with equity markets generally advancing around the world. In Europe, Ireland, Italy and Spain all successfully held debt auctions and saw their spreads tighten.

|

| Source: Global Macro Monitor |

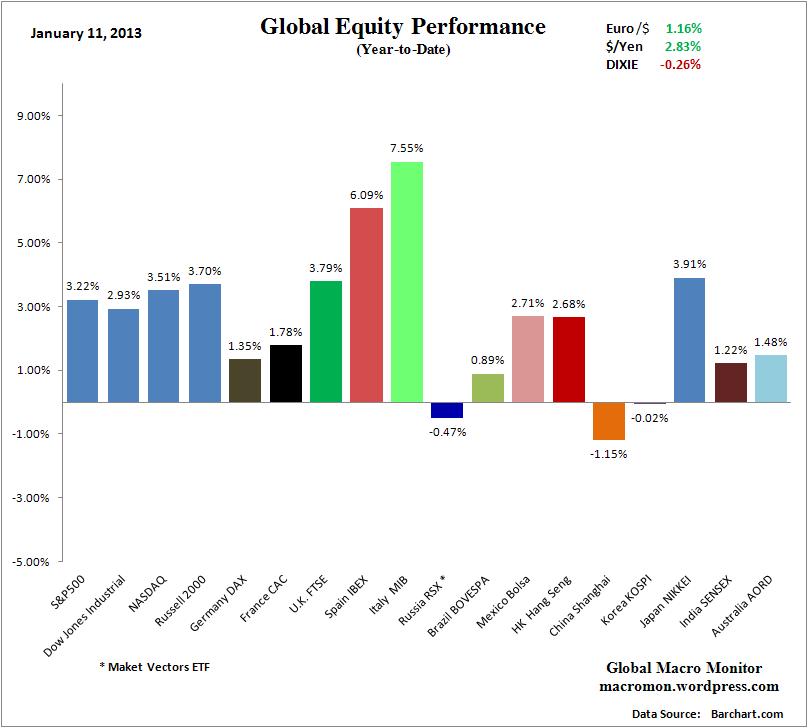

Feeding off of this, some of the best performing markets year to date are Spain and Italy.

|

| Source: Global Macro Monitor |

As we head into the heart of earnings season watch for changes to company earnings guidance in light of the increased taxes from the fiscal cliff solution. Both high end (increased taxes) and low end (back to normal Social Security taxes) retailers and vendors might be vulnerable. We also get some important economic data this week, including PPI, CPI, Industrial Production and the Fed's Beige Book.

At the same time as all of this information is coming in, some indicators are moving into area that investors might be getting a bit complacent. The AAII % of bears has dropped to 26.9%, while bulls are up to 46.5%. In addition, according to Thompson Reuters Lipper service individual investors poured over $18.3 billion into stock mutual fund and ETF's last week, the most net new cash, since 2008, and the most into equity mutual funds since May of 2001. While some of this may be investors coming back to the market after harvesting gains early in front of expected tax increases late last year, it is still disconcerting to see so much cash flow into equities this late in a cyclical bull. Overly bullish sentiment can leave the market vulnerable to negative news.

Finally, while Europe and Japan do seem to be getting better, the US government is expected to run out of money sometime on the second half of February. Overall, I am becoming more cautious on the domestic markets as we see how all of this turns out over the next several weeks.

No comments:

Post a Comment